December 17, 2019

What elements should you consider when evaluating a managed account service provider? From fees to data privacy, learn what you need to know about the managed accounts due diligence process.

The Due Diligence Process for Managed Accounts

In this episode, we dive into the due diligence process for evaluating managed account service providers. Our discussion covers:

- Why customization does not “turn off” the need for due diligence

- What specific topics to address with a managed accounts service provider

- What to do if a service provider cannot fulfill the requirements of the due diligence process

- Tips and examples of the process from client interactions

“The due diligence process is often something that gets overlooked when we talk about managed accounts… You can’t all of a sudden turn over the keys to a [managed account] provider without having done as thorough of due diligence as you would for any other investment manager in the retirement plan.”

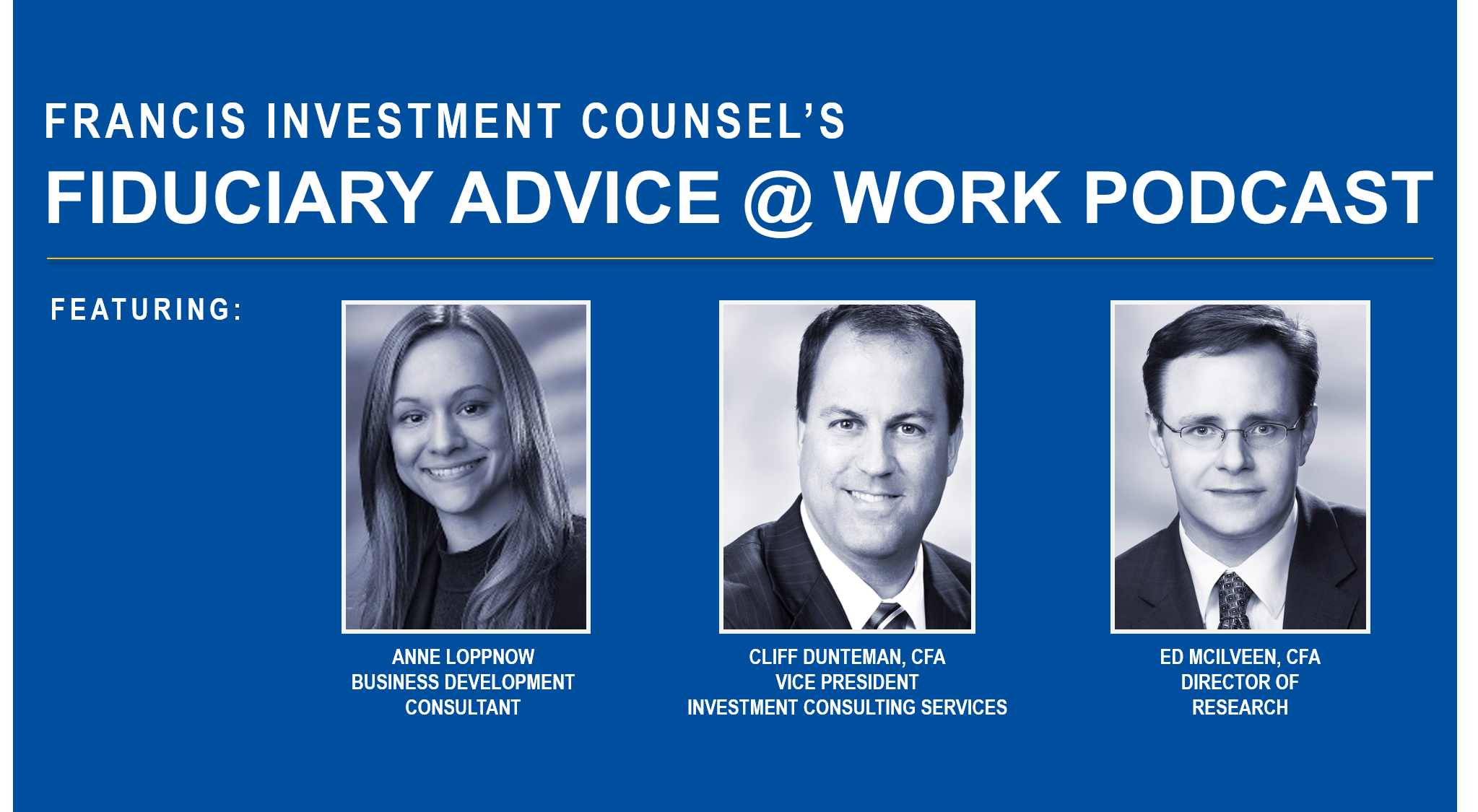

– Edward McIlveen, Director of Research