Most of us aren’t interested in holding down a job into our 80s, and nobody wants to be a financial burden on others, yet far too many people experience one or both of these fates because they fail to properly save for retirement.

How much you’ll need to save in order to afford to stop working someday depends on many factors. But one thing is certain, you need to start saving for retirement as early as possible because the number is a lot bigger than most people think. You can help your future self by following these fundamental rules of saving for retirement.

Set your goal

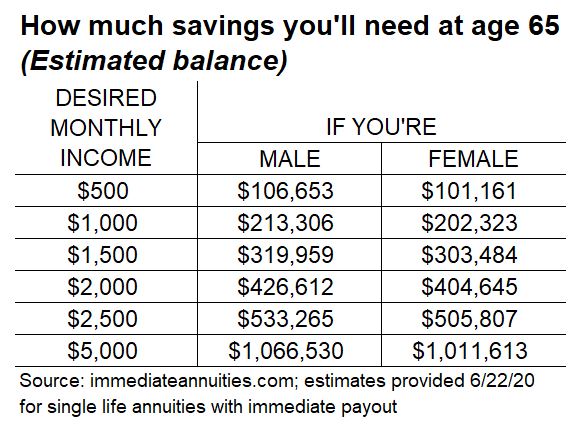

The easiest way to set your retirement savings goal is to start by estimating your monthly income needed in retirement. Most people begin by calculating how much income they would need if they retired today. Once you determine how much you need, subtract any future income sources such as Social Security payments from the total. Then adjust that number up for inflation based on the number of years until you retire. With this number in mind, and the included table, you can put your savings target into perspective.

Once you have this lump sum saving target, you can use any number of free online retirement savings calculators to estimate how much you need to save each month to reach your goal.

Prioritize your saving

Because there are so many things competing for the money left over after your bills are paid, you need to prioritize your savings. First, put enough aside to cover one month of expenses in an emergency savings account. Then, enroll in your workplace retirement plan to capture all of the company match. After you’ve accomplished that, pay-off any credit card and student loan debt. Finally, increase your saving in your workplace retirement plan to at least 10% if you’re in your 20s, and 15% if you’re in your 30s or older.

Control your debt

One of the biggest road blocks to saving enough for retirement is too much debt. While borrowing money to buy a home or a car is perfectly fine, you need to stay within a budget when doing so. Here are some good rules of thumb for controlling debt. Your monthly house payment, including real estate taxes, should not exceed 28% of your gross (before taxes) monthly pay. Total monthly debt payments should not exceed 36% of your gross monthly pay. Controlling your debt has the added bonus of improving your credit score which lowers the cost of your debt.

Minimize the taxes on your savings

Whether saving for retirement in a workplace retirement program or your own individual retirement account (IRA), you have a very important decision to make up front about what type of account to utilize: a traditional tax deductible account or a Roth account.

As a general rule of thumb, anyone under 50 years is likely to be better off utilizing a Roth account. This recommendation is based on the belief that over time, the benefit of tax free compounding of interest and earnings will outweigh the benefit of the upfront tax deduction you receive on the amount you contribute to a traditional account.

Track your progress

Acknowledging this is just a rule of thumb, here are some benchmarks you can use to determine if you’re on the right track with your retirement savings. For someone without an employer-sponsored pension benefit, you should target accumulating three times your annual take home pay saved for retirement by age 40, five times by age 50, and 10 to 12 times by retirement.

If you’re behind on your savings goal, you have two choices to get caught up. You can either crank up your savings rate, or take more risk with your investment strategy in hopes of increasing your annual rate of return. Remember, once you turn 50, you qualify to make “catch-up” contributions to your retirement accounts.

Stay focused

There’s no denying saving for retirement while life is happening all around us is a daunting task. The surest path to success is setting a goal and committing to a disciplined program of saving and investing to get there. Following these fundamental rules can help you reach retirement age able to afford to stop working and make your retirement a time of rest, relaxation, and fulfillment.

This column originally appeared in the Journal Sentinel. The material provided is for informational purposes only. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Francis Investment Counsel does not offer personal tax or legal advice.