Remember the SECURE Act?

In a recent article for the Star Tribune, Francis Investment Counsel’s Kevin Skow recapped some key provisions from the SECURE Act, detailing how the Act specifically affects plan participants. Joseph Topp also highlighted how the Act impacts plan sponsors in an article recently featured in WICPA’s On Balance magazine.

While still the most significant retirement legislation of the last 13 years, the SECURE Act drowned among headlines of the COVID-19 pandemic and resulting CARES Act. Understandably so!

It’s time to circle back and review how the SECURE Act affects plan sponsors and participants – and what provisions are in effect now or will be in effect soon.

SECURE Act provisions that are already in effect

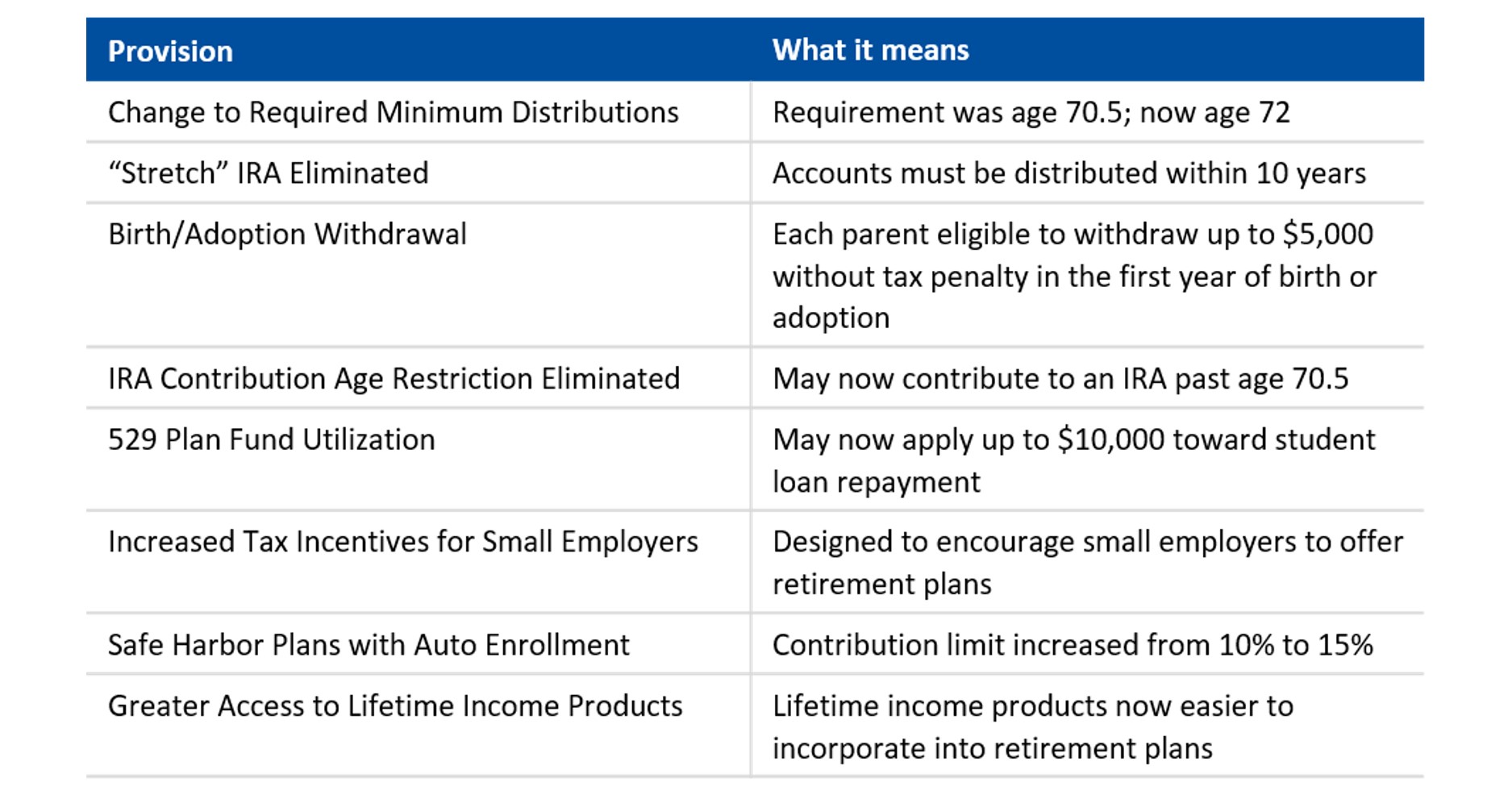

Here’s a summary of provisions that are already effective and what they mean:

SECURE Act provisions that are on their way

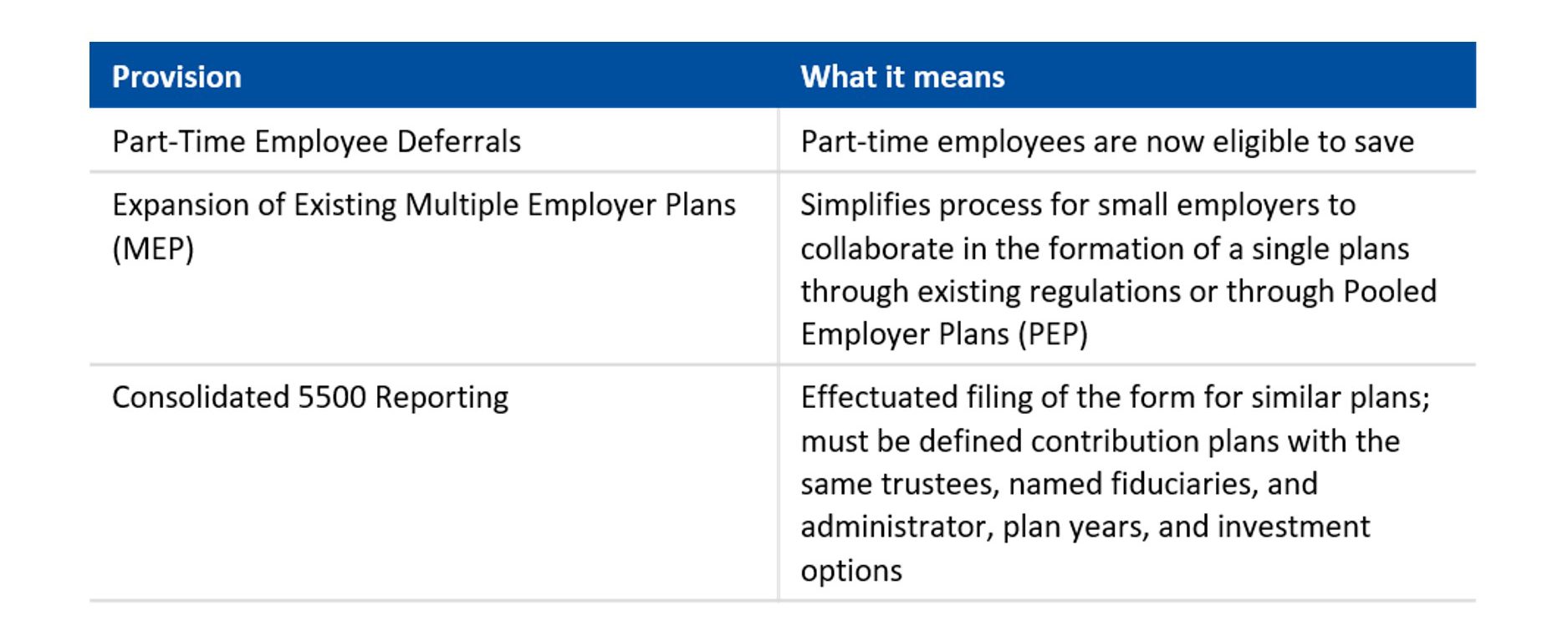

The following provisions are set to roll out in the future:

What to do next

These are, without question, major changes. Some are required; some are optional and may not be right for your company or employee base. If you have not done so already, reach out to your retirement plan recordkeeper and coordinate an approach. You can start your discussion with the following questions:

-

- What amendments to our plan are necessary to accommodate these provisions?

- What formal timeline will you deliver to ensure our plan remains in compliance with new requirements?

- What communications will be provided to plan participants regarding changes as the result of the SECURE Act?

As a plan sponsor, you’re accustomed to having a full plate. The SECURE Act presents a lot of new information, and it can be difficult to wade through and understand the nuances. Turn to the team of experts at Francis Investment Counsel for help. Our experience will help you make informed decisions for your plan and coordinate changes effectively with your plan service providers. Connect with one of our team members directly or fill out the form below for assistance.

Tags: SECURE Act, multiple employer plans, MEP, pooled employer plans, PEP, plan design